oklahoma state auto sales tax

Oklahoma collects a 325 state sales tax rate on the purchase of all vehicles. Typically the tax is determined by the purchase price of the vehicle given that the sale price falls within 20 of the average retail value of the car regardless of condition.

What S The Car Sales Tax In Each State Find The Best Car Price

This is only an estimate.

. Oklahoma has a statewide sales tax rate of 45 which has been in place since 1933. The actual excise tax value is based on the Blue Book value as established by the Vehicle Identification Number VIN. When a vehicle is purchased under current law a sales tax of 125 percent is levied on the full price of the car.

31 rows The state sales tax rate in Oklahoma is 4500. States with some of the highest sales tax on cars include Oklahoma 115 Louisiana 1145 and Arkansas 1125. 325 excise tax plus 125 sales tax 45 total for new vehicles.

Your exact excise tax can only be calculated at a Tag Office. Localities that may impose additional sales taxes include counties cities and special districts like transportation districts and special. Oklahoma excise tax provided they title and register in their state of residence.

Please note that special sales tax laws max exist for the sale of cars and vehicles services or other types of transaction. In Oklahoma localities are allowed to collect local sales taxes of up to 200 in addition to the Oklahoma state sales tax. The minimum sales tax varies from state to.

Until 2017 motor vehicles were fully exempt from the sales tax but under HB 2433 the exemption was partially lifted and motor vehicles became subject to a 125 percent sales tax. The Oklahoma state sales tax rate is 45 and the average OK sales tax after local surtaxes is 877. If the purchased price falls within 20 of the.

800 am to 430 pm. The maximum local tax rate allowed by Oklahoma law is. Does the sales tax amount differ from state to state.

405-607-8909 emailomvcokgov Office Hours. What states have the highest sales tax on new cars. Veterans receiving military retirement may exclude 75 percent of their retirement pay or 10000 whichever is greater on their state income return.

Oklahomas motor vehicle taxes are a combination of an excise sales tax on the purchase of a vehicle and an annual registration fee in lieu of ad valorem property taxes. This means that depending on your location within Oklahoma the total tax you pay can be significantly higher than the 45 state sales tax. 05 One-half of 1 percent Pay Tax.

Municipal governments in Oklahoma are also allowed to collect a local-option sales tax that ranges from 035 to 7 across the state with an average local tax of 4242 for a total of 8742 when combined with the state sales tax. The excise tax for new cars is 325 and for used cars the tax is 2000 for the first 150000 and 325 on the remainder of the sale price. Use our OkCARS - Sales and Excise Tax Estimator to help determine how much sales and excise tax.

325 of the purchase price or taxable value. States with high tax rates tend to be above 10 of the price of the vehicle. Counties and cities can charge an additional local sales tax of up to 65 for a maximum possible combined sales tax of 11.

68 1354 21860 escort services States with high tax rates tend to be above 10 of the price of the vehicle. Oklahoma has a 45 statewide sales tax rate but also has 470 local tax jurisdictions including cities towns counties and special districts that collect an average local sales tax of 4242 on top of the state tax. United States vehicle sales tax varies by state and often by counties cities municipalities and localities within each state.

OKLAHOMA CITY The Oklahoma State Senate passed a bill to reinstate full sales tax exemptions on motor vehicles and trailers. With local taxes the. Oklahoma has a statewide sales tax rate of 45 which has been in place since 1933.

State Assessment - Public Service Section Forms Publications Legislative Information Mapping Assessors Only Site Sales Use Tax Retailer and Vendor Information Information for Cities and Counties Sales Use Tax PublicationsCharts Sales Use Tax Tools. Oklahoma Motor Vehicle Commission. Veterans can apply for a vehicle sales tax exemption online with the Oklahoma Taxpayer Access Point.

4334 NW Expressway Suite 183 Oklahoma City OK 73116 Phone. With local taxes the total sales tax. Motor Vehicle Excise Tax Purchase Types New Vehicle.

Senate Majority Leader Kim David presented State Bill 593 on Tuesday. Keep in mind Oklahomas state income tax rate ranges up to 5 percent depending on income. This method is only as exact as the purchase price of the vehicle.

Darcy Jech R-Kingfisher would modify this calculation so the sales tax would be based on the difference between the actual sales price of a vehicle and the value of a trade-in if applicable. The Oklahoma state sales tax rate is 45 and the average OK sales. 325 excise tax plus 125 sales tax 45 total for new vehicles Oklahomas motor vehicle taxes are a combination of an excise sales.

Senate Bill 1619 authored by Sen. Some states charge annual excise fees for vehicles or a fee whenever you renew your registration.

Ford Com Ford C Max Hybrid Max Ford

Oklahoma Vehicle Sales Tax Fees Calculator Find The Best Car Price

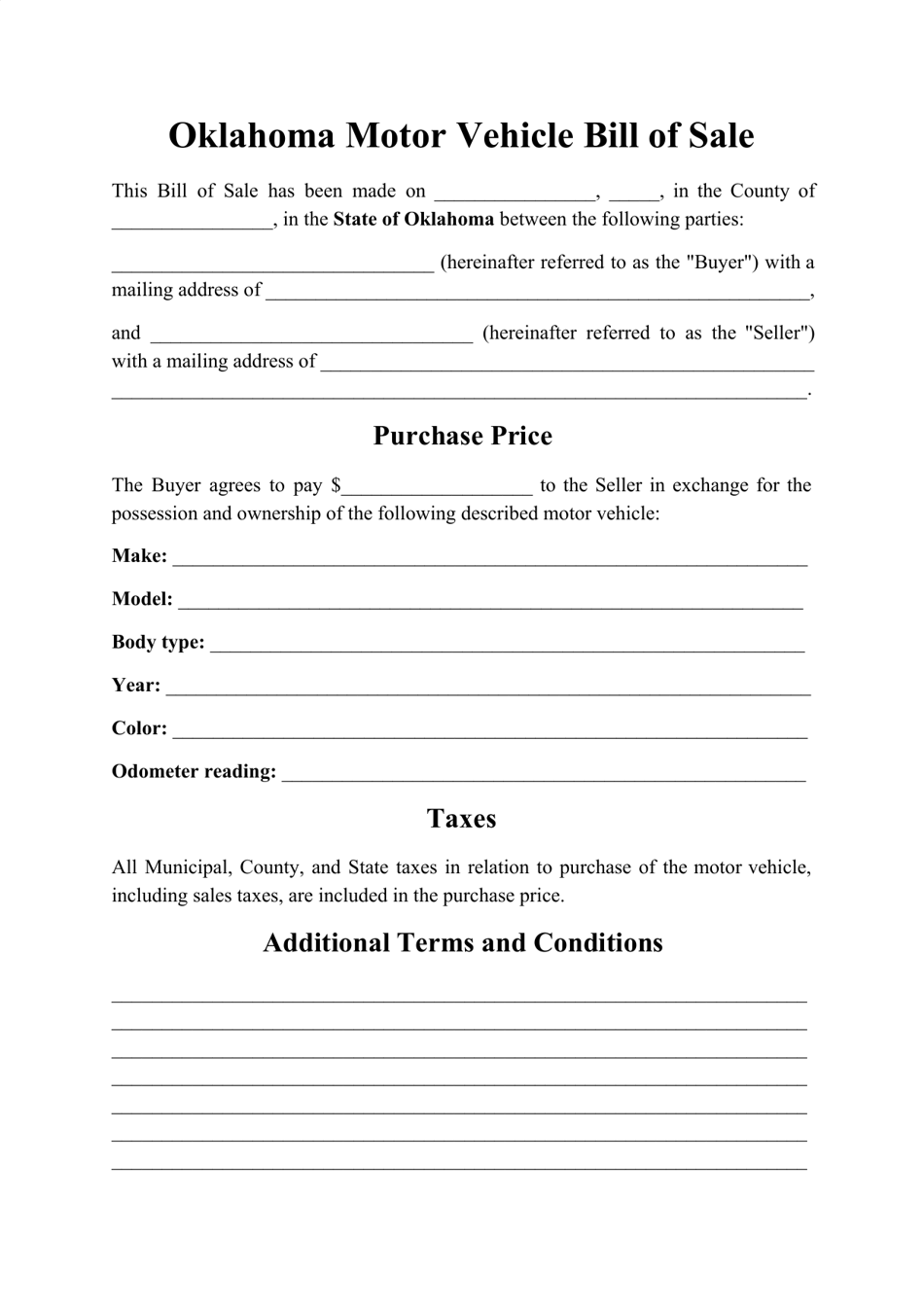

Oklahoma Motor Vehicle Bill Of Sale Form Download Printable Pdf Templateroller

Oklahoma Auto Dealer License Guide Surety Bond Insider

Oklahoma Vehicle Sales Tax Fees Calculator Find The Best Car Price

Auto Dealers Lobby To Close Oklahoma Tesla Service Center Cleantechnica

Car Sales Tax In Oklahoma Getjerry Com

6 Students Killed In Oklahoma Crash Were In Car That Seats 4 The Spokesman Review

Used Cars For Sale In Chickasha Oklahoma Charles Allen Ford Inc

Pin On Handmade Shop Tips For Etsy Sellers Makers And Handmade Entrepreneurs

How To Sell A Car In Oklahoma Documents Required And More

Free Oklahoma Motor Vehicle Dmv Bill Of Sale Form Pdf

Oklahoma Dealer License Guide New Used And Wholesale

Tesla Asks Fans In Oklahoma And Mississippi To Fight New Bills To Ban Direct Sales Of Electric Cars Electrek

![]()

Free Oklahoma Motor Vehicle Bill Of Sale Form Pdf Word

Buy A Used Car In Hugo Oklahoma Visit Ed Wallace Ford

Audi Vehicles For Sale At Bob Moore Bob Moore Auto Group

Oklahoma City Bombing City Neon Lighting

Tesla Service Centers In Oklahoma In Jeopardy After Hb3994 Heads To House