springfield mo sales tax rate 2020

Within Springfield there are around 15 zip codes with the most populous zip code being 65807. Personal property tax is assessed on livestock mobile homes commercial office equipment farm equipment machinery tools and leased commercial property ie.

Financial Reports Springfield Mo Official Website

Home mo rate tax wallpaper.

. Springfield in Missouri has a tax rate of 76 for 2022 this includes the Missouri Sales Tax Rate of 423 and Local Sales Tax Rates in Springfield totaling 337. Springfield collects a 3375 local sales tax the maximum local sales. Statewide salesuse tax rates for the period beginning August 2022.

Statewide salesuse tax rates for the period beginning October 2020. Click here for a listing of sales tax rate changes in the current quarter. Compared to budget through May 2020.

State Local Sales Tax Rates As of January 1 2020 a City county and municipal rates vary. The city sales tax rate of 2125 includes a 1-cent General Sales Tax 14-cent sales tax for capital improvements 18-cent. What is the sales tax rate in Springfield Missouri.

The Missouri state sales tax rate is 423 and the average MO sales tax after local surtaxes is 781. There is no applicable special tax. 052022 - 062022 - XLS.

Raised from 6225 to 8725. This is the total of state county and city sales tax rates. If an employer pays state taxes timely the 6 rate will be reduced by 54 and the employer will pay their federal UI tax at a rate of 6.

This home was built in 1961 and last sold on for. This page will be updated monthly as new sales tax rates are released. 072020 - 092020 - PDF.

KY3 - The city of Springfield says its latest sales tax check is more than 1 million over budget. 042022 - 062022 - XLS. 15 lower than the maximum sales tax in MO.

Subtract these values if any from the sale price of the unit and. Sales and Use Tax Rate Card- For current rates. Statewide salesuse tax rates for the period beginning November 2020.

Statewide salesuse tax rates for the period beginning July 2020. Comes from sales tax and use tax-38 General Fund 1 Sales Tax Revenue FY 2020 Budget FY19 Actual FY20 Actual88 Year-to-date sales tax revenues are down -38 compared to budget through April 2020 The City of Springelds April sales tax revenues from the Missouri Department of Revenue came in at 3791426. You can find more tax rates and allowances for Springfield and Missouri in the 2022 Missouri Tax Tables.

These rates are weighted by population to compute an average local tax rate. Greene County Collectors Office. 33 13 of appraised value.

California 1 Utah 125 and Virginia 1. 2938 W Harrison St Springfield MO 65802-5148 is currently not for sale. Sales tax rates change at the start of the quarter never in the middle of a quarter and can only be changed by a vote of the people at that location.

Budget FY19 Actual FY20 Actual. This includes the rates on the state county city and special levels. The 81 sales tax rate in Springfield consists of 4225 Missouri state sales tax 175 Greene County sales tax and 2125 Springfield tax.

The City of Springelds May sales tax revenues from the Missouri Department of Revenue came in at. The average cumulative sales tax rate in Springfield Missouri is 782. The citys finance director David.

If the state has an outstanding loan for 2 years and is unable to pay back the loan in full by November 10th of the second year the 6 rate will be reduced by only 51 changing the percentage an employer will pay their federal UI tax to 9. You can print a 81 sales tax table here. For other states see our list of nationwide sales tax rate changes.

The Springfield Sales Tax is collected by the merchant on all qualifying sales made within Springfield. Did South Dakota v. You pay tax on the sale price of the unit less any trade-in or rebate.

Springfield is located within Greene County Missouri. The Missouri sales tax rate is currently. Leased computers etc Source.

Year-to-date sales tax revenues are up 01. These rates are valid for this location for this quarter for the sales and leases of tangible personal property items and taxable services. 052020 - 062020 - PDF.

B Three states levy mandatory statewide local add-on sales taxes at the state level. We include these in their state sales tax. 102020 - 122020 - PDF.

072022 - 092022 - XLS. 55499 per 100 of assessed value. Springfield mo sales tax rate 2020 Saturday March 12 2022 Edit.

Your current sales tax rate is. Missouri has 1090 special sales tax jurisdictions with local sales taxes in addition to the state sales tax. Single-family home is a 3 bed 20 bath property.

The Springfield Missouri sales tax is 760 consisting of 423 Missouri state sales tax and 338 Springfield local sales taxesThe local sales tax consists of a 125 county sales tax and a 213 city sales tax. The County sales tax rate is. Statewide salesuse tax rates for the period beginning May 2022.

Statewide salesuse tax rates for the period beginning July 2022. This is the total of state county and city sales tax rates. Statewide salesuse tax rates for the period beginning July 2020.

Did South Dakota v. Single-family home is a 3 bed 20 bath property. Use this calculator to estimate the amount of tax you will pay when you title your motor vehicle trailer all-terrain vehicle ATV boat or outboard motor unit and obtain local option use tax information.

When the sales tax rate changes at your location be sure to generate and print new rate cards as needed. The minimum combined 2022 sales tax rate for Chesterfield Missouri is. Higher sales tax than 62 of Missouri localities.

11 2020 at 604 PM PDT. The County sales tax rate is. Counties and cities can charge an additional local sales tax of up to 5125 for a maximum possible combined sales tax of 9355.

Statewide salesuse tax rates for the period beginning April 2022. The Chesterfield sales tax rate is. As far as sales tax goes the zip code with.

The Springfield sales tax rate is. The minimum combined 2022 sales tax rate for Springfield Missouri is. The Missouri sales tax rate is currently.

Setting Up Sales Tax In Quickbooks Online

Setting Up Sales Tax In Quickbooks Online

.jpg)

Hvs 2021 Hvs Lodging Tax Report Usa

Michigan Sales Tax Guide For Businesses

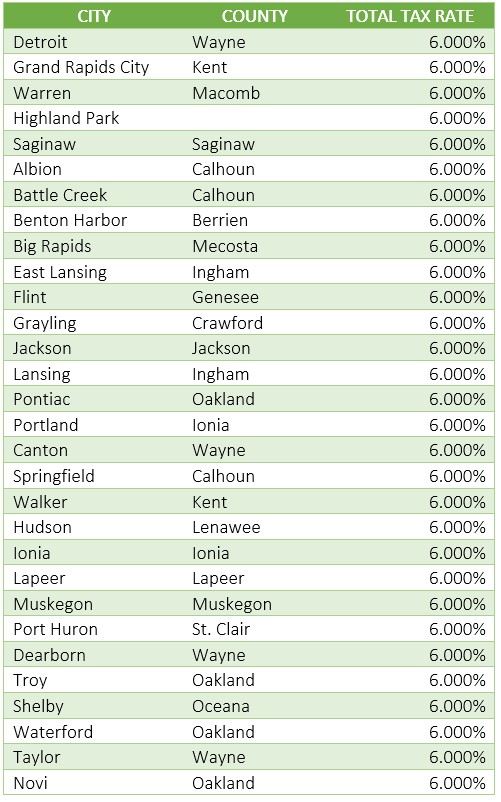

Missouri Sales Tax Rates By City County 2022

Missouri Car Sales Tax Calculator

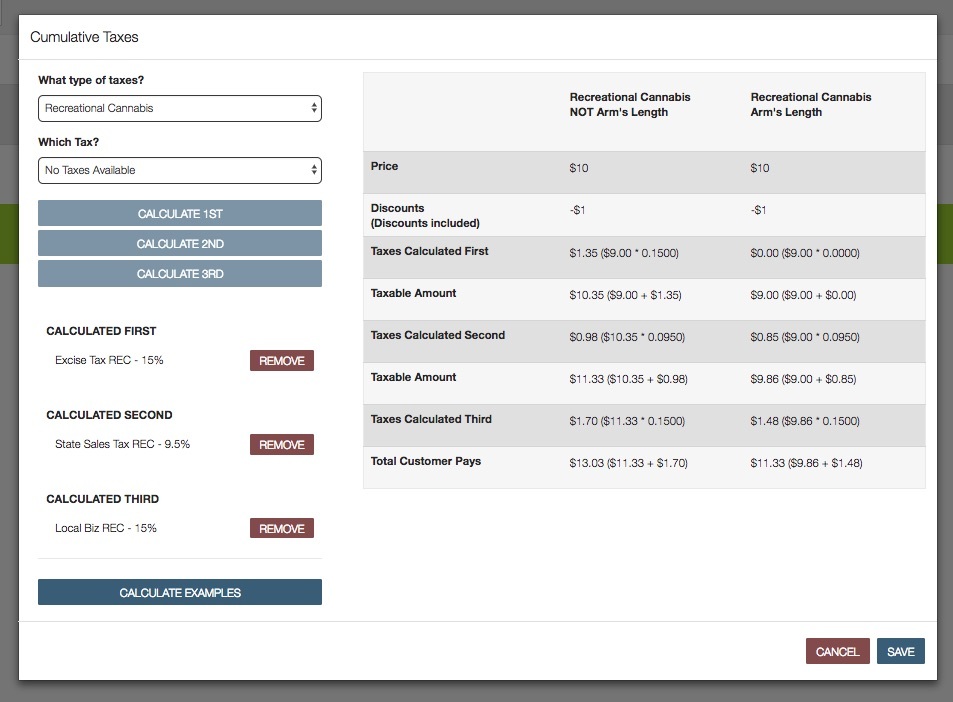

How To Calculate Cannabis Taxes At Your Dispensary

2nd Tax On Receipts Confuses Customers At New Walmart Youtube

Missouri Income Tax Rate And Brackets H R Block

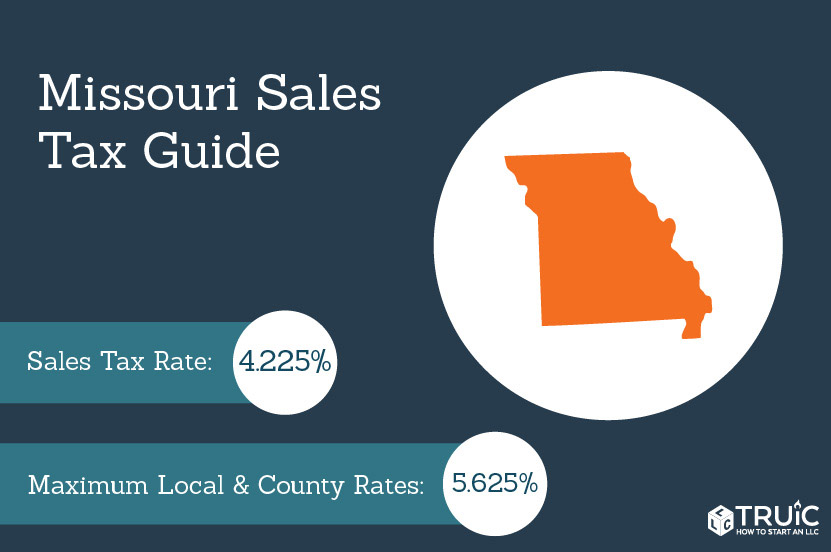

Missouri Sales Tax Small Business Guide Truic

How To Calculate Cannabis Taxes At Your Dispensary

Taxes Springfield Regional Economic Partnership

Sales Tax On Grocery Items Taxjar

Setting Up Sales Tax In Quickbooks Online

States Are Imposing A Netflix And Spotify Tax To Raise Money